If you want to start receiving international payments for your business, you’ll need a Payoneer account. While they are not the only company that provides this service, it is one of the most popular because of its competitive rates and wide selection of deposit methods. In this post, we’re going to walk through how to open a Payoneer account so that you can get started sending and receiving global payments today!

What is a Payoneer account, and how does it work?

A lot of people confuse Payoneer accounts and Paypal. Like PayPal, you can use your Payoneer account as a hub for transferring money online, whether receiving payments from clients or even making international transfers on your own. However, unlike PayPal, there are no transaction or monthly fees. You can deposit money into your account and then withdraw it when you need to make a payment, making Payoneer accounts very flexible for people who work online in multiple currencies.

How do I sign up?

The first step is to go onto their website at payoneer.com. They will ask you for some personal information like your name, address, contact number/email address, etc., before asking if you want to open an individual or business account (we recommend opening an individual one). And that’s pretty much it! An important thing to remember is that they don’t accept US citizens as customers, so if you’re American, unfortunately, this isn’t the company for you.

A step-by-step guide on how to open a Payoneer account

How to Open a Payoneer Account. 1st Step Sign Up for an account at payoneer.com by clicking here or on the link below! Register Here

Will be credited you and me with 25 dollars each once you receive your first paycheck using this referral code. Download and fills in the form, then click submit! You will be asked to create a password for logging into your account (Be sure it’s something you can remember!)

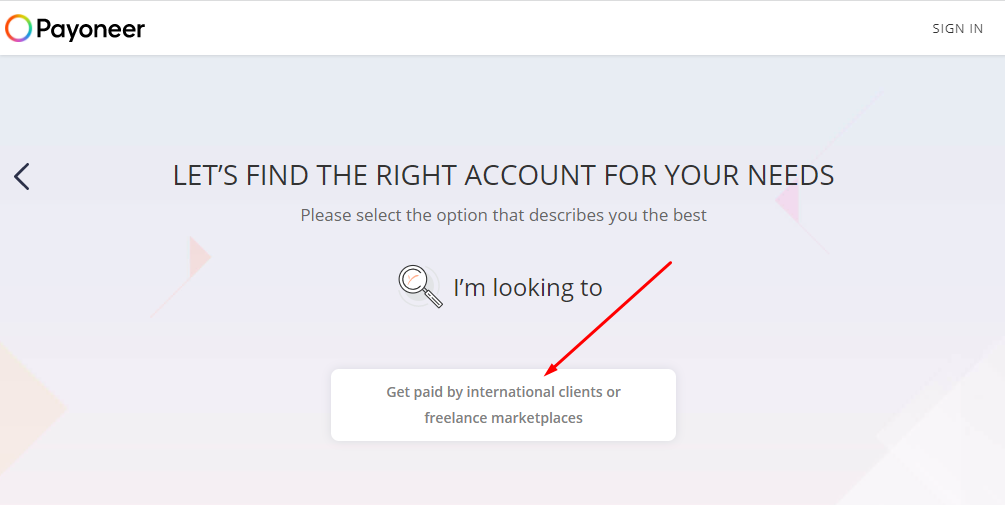

2nd step is if you are a freelancer, choose this arrow button, and then if you are not a freelancer, choose any one option that’s your identity.

3rd step click on arrow sign

4th step if your estimate is earning less than $10000 so click on this round ball

step 5 click on register button

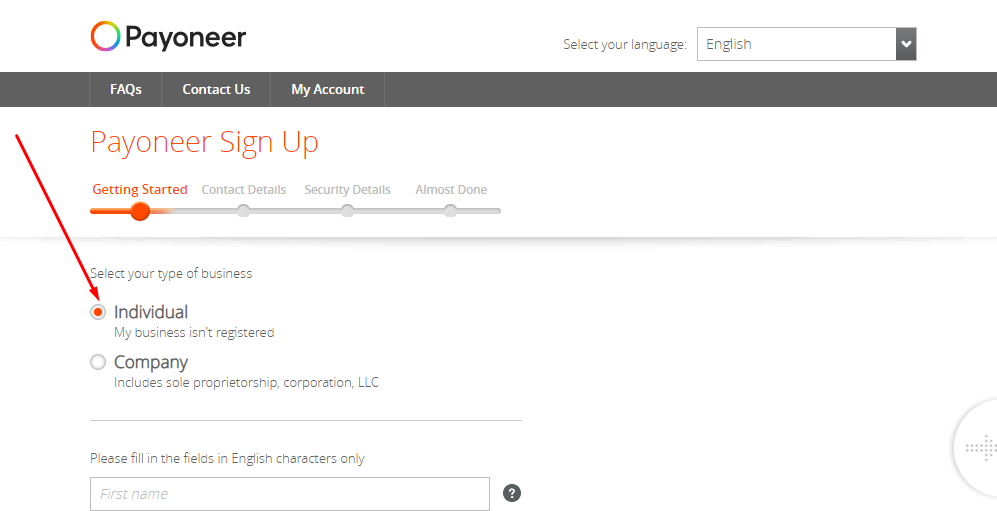

6th step if you are not a company owner, then click individual

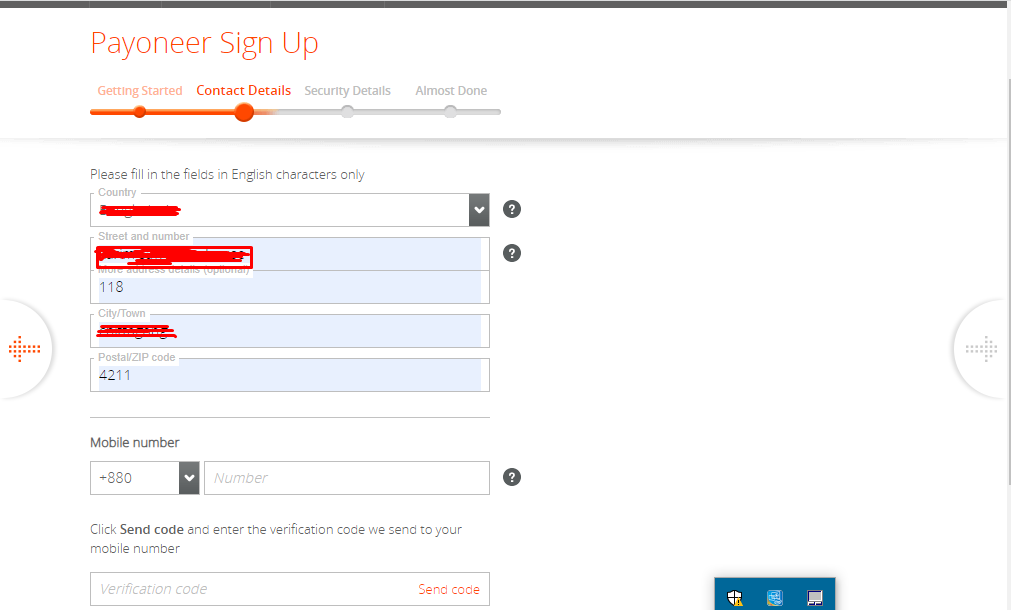

step 7th is to give your name or company name and address, must be given phone number then click get code and you have got a massage a to verify code then click next step

Step 8th is to give your username and give a strong password, click security question remember this security question, and answer in future need it when you forget password or change password.

How to verify your identity with the company?

Now, the next step is to verify your identity with Payoneer. To do this, they will need you to download their software, which uses a webcam and microphone on your computer to record a short video of yourself and some audio where you say,

The process should take around 15 minutes to complete depending on your internet connection.

Once you have successfully verified yourself, I recommend withdrawing some money into your bank account. By doing this, not only do you get paid for completing tasks, but it also means that if Payoneer shuts down unexpectedly (as has happened in the past with companies like Paxum), at least you can withdraw what’s left!

What currencies are accepted?

Pay Payoneer only allows people from countries outside the United States to open an account, so citizens there cannot use them. Unfortunately, if you’re based somewhere like Australia, Australia, or the UK, they are perfect for accepting payments internationally!! They also offer EUR,, GBP, and CAD accounts which means all members around the world can make international transactions quickly and efficiently using their platform plus withdraw in local currency too 🙂 🙂 What makes this even better is that PayPal fees aren’t hidden away within the transaction, unlike PayPal.

What are the requirements to open a Payoneer account?

To open a Payoneer account, you will need A valid bank account to accept international payments. At The very least, 16 years of age (The legal working age in the United States). An email address and phone number. To have at least one form of identification, such as an ID card or passport.

To open a Payoneer account, you will need A valid bank account to accept international payments. At The very least, 16 years of age (The legal working age in the United States). An email address and phone number. To have at least one form of identification, such as an ID card or passport.

How much does it cost?

To open a Payoneer account, you do not need to make any upfront payment! They don’t charge their members fees for using their platform – which is excellent!! However, some banks may charge transfer fees when receiving/sending funds into your Payoneer account from/to your local bank.. It’s best if you check with your specific financial institution before signing up 🙂

What is the minimum withdrawal on Payoneer?

The minimum withdrawal for Payoneer is $50, which means that they are also great to use as an online payment method! You can withdraw your money into your bank account or send it straight into someone else’s Paypal/skrill account too :)!! The only downside of this platform is that you cannot withdraw directly through them – you need to draw into your local bank account.

Who needs a Payoneer account?

If you are based outside the United States, this is an ideal platform for transferring money abroad! They also work well with freelancers who want to accept payments internationally.. For example, if you were working as a virtual assistant or designer and wanted someone in China or Australia to send you payment – they could use Payoneer :)!! Or suppose the company they work for is based in another country and also has an overseas location. In that case, it’s a great idea to set up an account with Payoneer as it is easy to transfer funds to their employees’ accounts, which means no more costly wire transfers to international locations. ;)!! It’s a great option, especially for beginning to build your business online or your career, as it will make it simpler to pay your bills and work wherever you like as well. ;)!! This is especially beneficial when you’re just beginning to build your online business or career because it makes it simpler to pay your bills and work wherever you like as well.

What is the process of opening a Payoneer account?

The Payoneer application process can complete in around 15 minutes! However, I recommend using this platform alongside PayPal because although they are both great platforms for receiving international transactions, some countries cannot use Paypal but can use Payoneer. It’s best to have both ;)!! To open up your Payoneer account, follow these steps: Fill out an application form. Once approved by their team, verify your bank account. Upload all necessary documents required (Passport/ID card). Start receiving funds into your new foreign currency US dollar-based American Express Prepaid Card Account instantly 🙂

The downsides of using Payoneer

If you want to receive payments faster, then Paypal is probably the better option for you since they can instantly transfer funds. However, if your business requires sending money abroad or receiving vast amounts of international transactions – Payoneer would be a great platform because there aren’t any fees attached, and it’s free to open up!! I also like that they give you a US dollar-based card (which is great for traveling) and the ability to withdraw up to $20,000 per month into your local bank account!! They also work well with freelancers who want to receive international payments.

Conclusion paragraph:

Now that you know how to open a Payoneer account, it’s time to get started. If you have any questions or concerns about the process, feel free to reach out, and we will be happy to help!